The Hellenic Competition Commission may initiate a mapping study to assess the competitive conditions of competition in any market or sector of the economy, when required for the effective exercise of its powers.

In this context, the Authority launched a mapping study on the conditions of competition in the market for animal feed, focusing, in particular, on feed for sheep and goats. Sheep and goats were chosen because these productive animal species constitute the largest part of the livestock population in Greece (with the exception of chicken) as well as on the fact that sheep and goat milk is used exclusively for the production of feta cheese, which is a product of significant importance to Greek consumers and represents 2% of retail chain sales.

This mapping study is complementary to the mapping of the veterinary medicinal products (VMPs) market initiated by the relevant HCC Decision in May 2024. (see press release).

Both mapping studies are part of the Authority's strategic goal to assess the conditions of competition in the agri-food sector in Greece, focusing on the supply chain of basic food products.

In particular, animal feed represents around the 75% of livestock farming costs, while the compound feedstuffs price index increased by 33% from 2020 to the third quarter of 2023. It is noted that, according to Eurostat, the cost of animal feed is the largest cost factor for livestock farming in Greece.

In particular, the purpose of the mapping study on the animal feed sector is to determine:

a) Customer categories and geographical areas of activity, market shares and the degree of market concentration at the wholesale distribution level.

b) The evolution of purchase and sale prices and quantities in total and by customer category.

c) Profit margins, based on financial statements (at company level).

Data collected from 41 feedstuff production and marketing companies were assessed .

The period for which data was obtained extends from 1/1/2021 to 30/6/2024 (Period of Reference).

The main findings are as follows:

- The animal feed industry is characterised by "economies of scope" and the supply of animal feed for sheep and goats is linked with the supply of other animal feed products and other activities related to other productive animals.

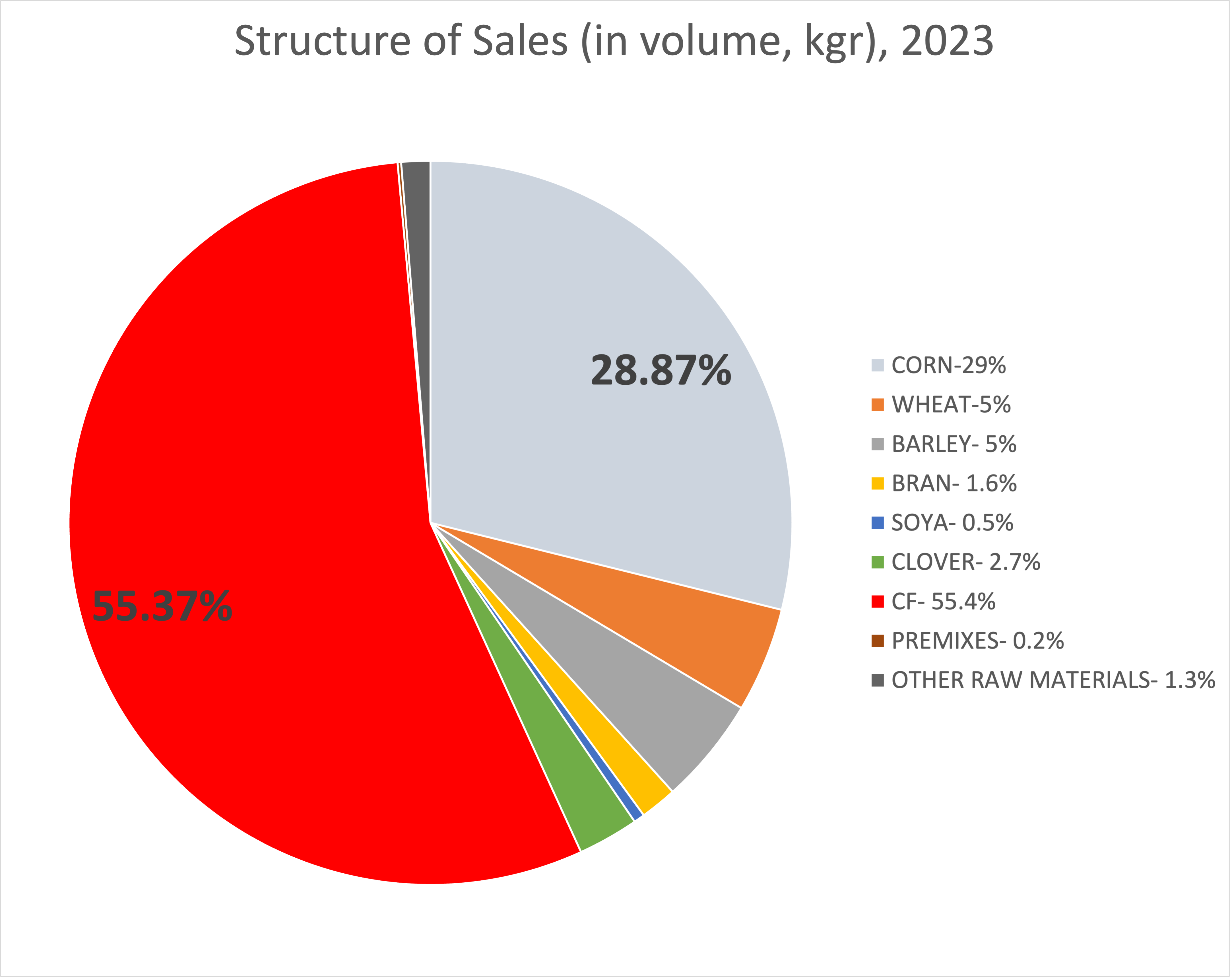

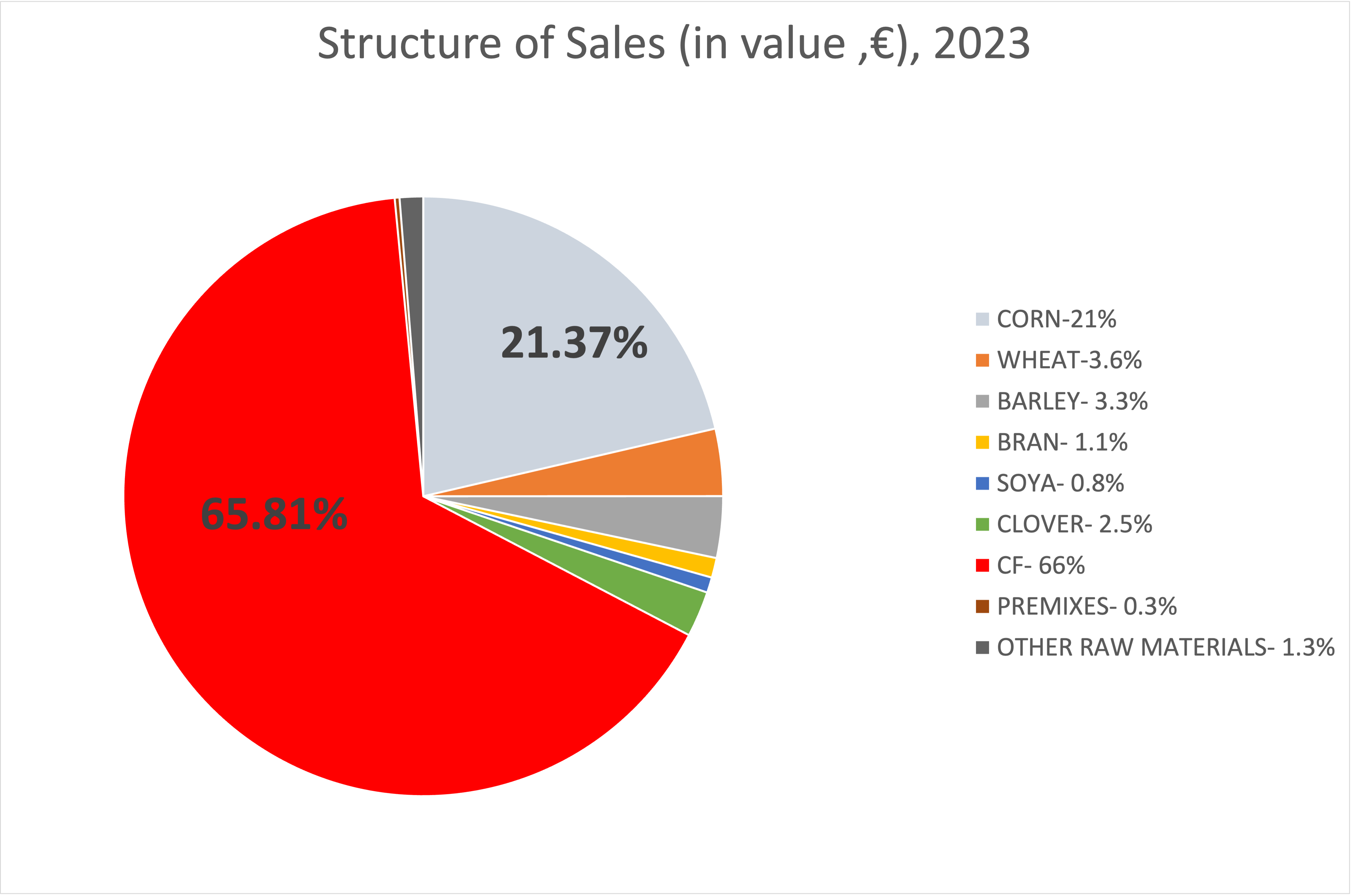

- Animal feedingstuffs are divided into feed materials and compound feedingstuffs. Feed materials (FM) are raw materials ((i.e. crop products used as animal feedstuffs such as corn, wheat, barley, soya, bran, clover etc). Compound feedingstuffs (CF) are mixtures of at least two feeding raw materials, whether or not containing additives.

- In 2023, total FM for sheep, goats and other productive animals concern the 14.2% of the turnover of the companies, included in the sample, and CF sheep and goats concerns the 9.7%.

- In 2023, the 62.7% of the purchases of animal feed for sheep and goats come from Greece, while the remaining purchases are made mainly from Romania and Italy.

- Regarding the structure of animal feed sales of the companies included in the sample, it is found that, both in terms of value and volume, the largest percentage of sales concerns CF (by 65.8% in value and by 55.4% in volume).

|

|

| Source: Companies' Data |

- In the CF category for sheep and goats, the sector is characterised by low concentration as CR4 and CR5 for the year 2023 are estimated at 41.6% and 48%, respectively. The same conclusion is confirmed by the Herfindahl Index which, for 2023, is estimated at 665 points. Moderate concentration is observed in the Clover category, while a high degree of market concentration is observed in Premixes.

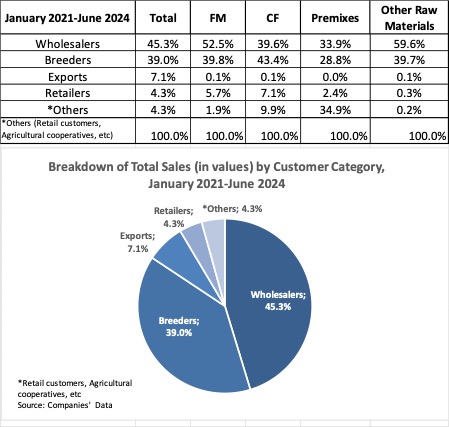

- Regarding customer categories in the sample, 45.3% of sales of animal feed for sheep and goats are channeled to wholesalers and 39.0% directly to breeders. In FM and CF, no notable price differentiation is observed between wholesalers and breeders. Slightly increased prices are found in the retailers’ category which is, to a large extent, anticipated.

|

| Source: Companies' Data |

- In 2023, regarding the SF category, a higher percentage of sales is observed in Central Greece and specifically in the regions of Thessaly (2023: 27.9%) and Epirus (2023: 41.9%) and to a lesser extent in Crete (14.3%), while in the category CF for sheep and goats a higher percentage of sales is observed in Central Macedonia (2023: 36.6%) and in Crete (35.1%). Peloponnese, Central Greece, Western Greece and Thrace present small percentages in sales in both SF and CF.

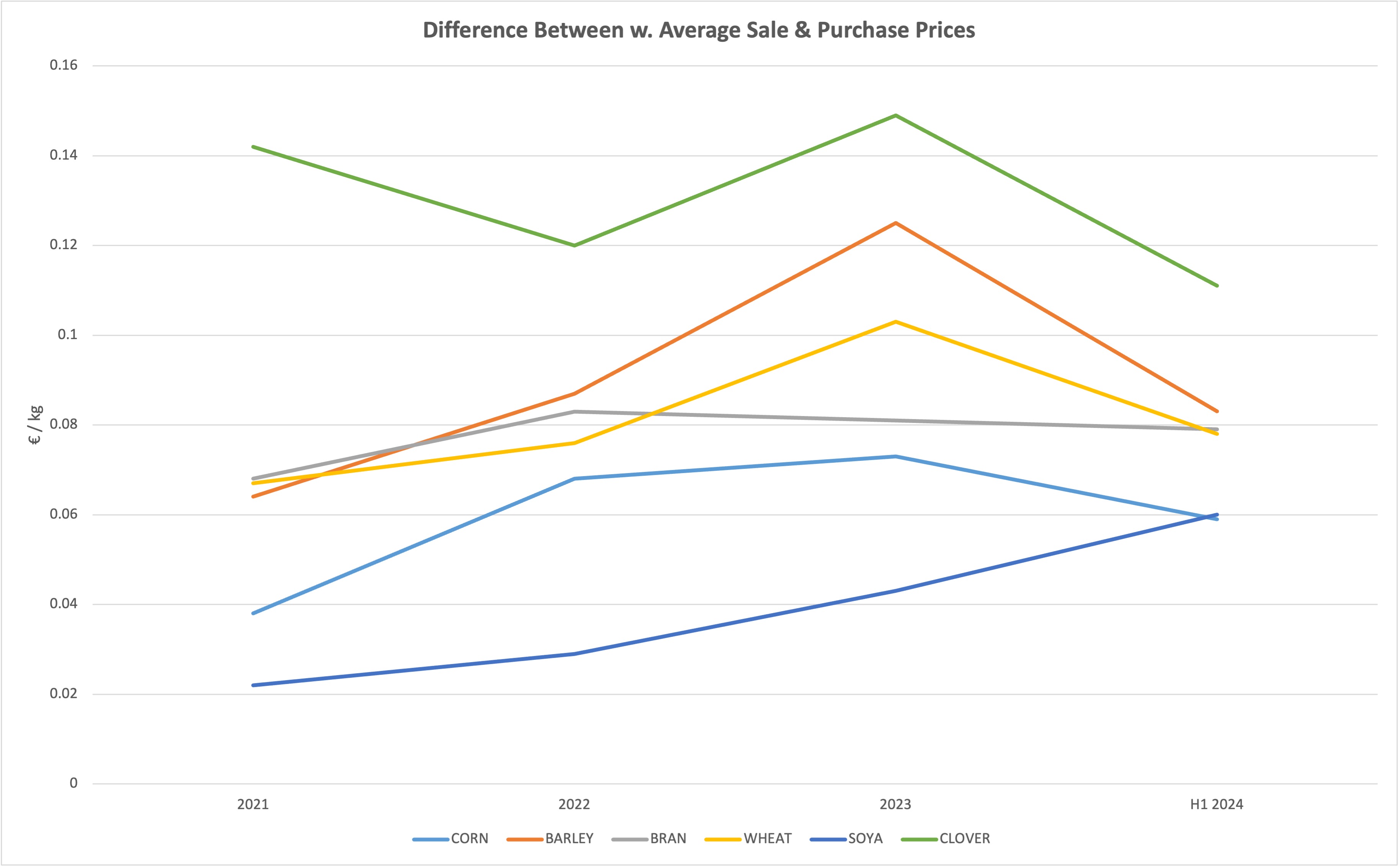

- Regarding FM/Raw Materials purchases by production/trading companies, an increase in average purchase prices is observed in 2022 compared to 2021, while in 2023 prices follow a downward trend. This decrease continues in the first half of 2024, where prices are even lower than in 2021. The average CF purchase prices show a similar trend.

- Regarding pricing policy, several companies that participated in the survey reported that, where products are traded on international markets, they price them based on the respective international prices on the date of each sale, regardless of the product purchasing origin (i.e. purchased from Greece or abroad).

- The trends in the sales prices of the companies included in the mapping survey, appear to follow the respective purchase prices for each product, the respective international indexes, possibly due to competition from abroad, even if this happens at a different pace of response to increases and decreases. Any deviation from this pricing method may lead to a loss of customers.

- However, it is found that price spreads (i.e selling prices minus purchase prices) are not consistent but increase until 2023, even though energy has been a small percentage of the total costs of companies in the animal feed industry over time, according to the Eurostat data. The increasing spread of each product does not appear to be a result of energy price evolution.

|

| Source: Companies' Data |

- There is no selling prices alignment among firms for raw materials and compound animal feed, but only a similar trend in the rise and the fall of prices.

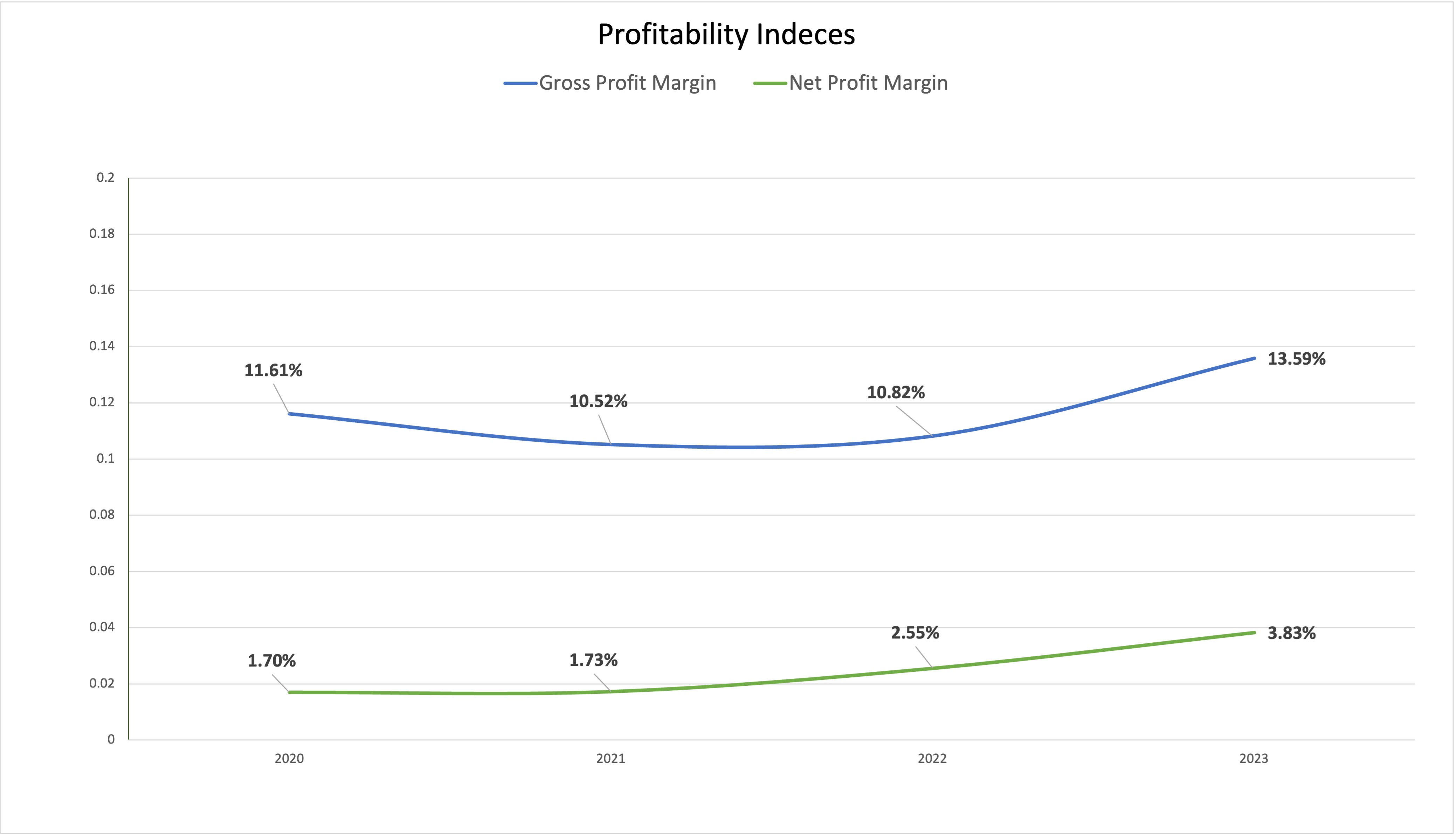

- The companies participating in the sample, in total present an average Gross Profit Margin of between 10% and 13.6% and an average Net Profit Margin of between 2% and 4%. However, it is observed that, in 2023, when international commodity and energy prices decline, companies’ profit margins increase.

|

| Source: Companies' Data |

More information on the mapping of the conditions of competition in the animal feed sector is available on the HCC’s dedicated webpage (here).

--------------

percentage of sales intended for sheep and goats. In CF for sheep and goats, it is estimated that there is higher precision in calculating the shares.

- The calculations have been made with normalised (price per kilo) and weighted prices.

- Prices are net of VAT and discounts. The reason why VAT was excluded is that in purchases from abroad VAT is 0%, while in domestic purchases this tax ranges from 6% to 24% depending on the product

- The level of discounts could not be precisely calculated as companies, according to their credit policy, offer various categories of discounts not only on product price but also on total invoices issued, quarterly or annually, and depending on the volume of quantities sold and the payment method.

- In any case, the percentage of discounts resulting from the credit invoices requested, constitutes a very small percentage of the total values per year.