Following the publication of the Interim Report, the public consultation, as well the analysis of the updated data collected during 2020, the Hellenic Competition Commission (HCC), published its Final (market study) Reportin the field of production, distribution and marketing of basic consumer goods and in particular food products, as well as cleaning and personal hygiene products. You can access the executive summary here.

The main conclusions and HCC’s decision on the suggested solutions are:

- Due to the significant changes in consumer habits in recent months (associated with the current difficult and extraordinary conditions due to COVID-19 pandemic), the expected entry of new business models in the market, but also due to the limitation of the scope of this Sectoral Inquiry to certain product categories, it is not considered necessary at the moment to initiate a regulatory intervention in the sector or to consider the introduction of new institutions, such as that of an Ombudsman or Commissioner appointed by the HCC who would negotiate a Code of Conduct or a Best Practices Guide between the parties involved.

- Such possibility will be considered after the conclusions of the new Supermarket Sector, which is planned in the medium term - in two years - and which will cover more and, possibly, different product categories; a selection that will be made based on the systematic processing of data collected by the HCC Economic Intelligence Platform already, as of January 2020.

- It is considered necessary that the HCC continues to monitor the sector, both for the specific consumer products examined in the context of this Sectoral Inquiry (SI), as well as for other products, food or other basic consumer products. This task will be undertaken by a Supermarket Taskforce set up at HCC’s Directorate-General (DG), which will prepare a report every 12 months, addressed to the HCC’s President, on the state of competition in the retail sector and which will measure the bargaining power of supermarket chains as well as suppliers. The final selection of supply markets to be examined by the new SI planned in the medium term will be based on the findings of the above mentioned periodic studies. The Taskforce team should also, in cooperation with other HCC’s relevant directorates and departments, propose specific Guidelines to be concluded in the first half of 2022, for the application of competition rules in the retail sector (supermarket).These specific Guidelines will analyse, inter alia, the definition of the relevant market, the way in which the bargaining power and the specific methodology developed in this SI by HCC will be taken into account when exploring a dominant position in the market, as well as analyse specific categories of commercial practices, including unfair commercial practices, which may constitute an exploitative abuse of dominant position.

- Several of the competition problems are related to the exercise of bargaining power and can possibly be solved by a carefully designed application of articles 1, 2 of Law 3959/2011 and of articles 101, 102 TFEU. These could concern:

- When defining the geographical downstream market (market of sales to final consumers), the HCC will also take into account local competition.

- Investigations concerning dominant position, should take into account the particularities of the industry and especially the lack of intense intra-brand competition in some premium Fast Moving Consumer Goods (FMCG) products or the central role of some large supermarket chains or electronics platforms that can have a “gatekeeper” role in some markets and may also distribute private label products.

- There is particular interest in exploitative abusive practices, which consist of the imposition of unfair or burdensome terms by a dominant undertaking.

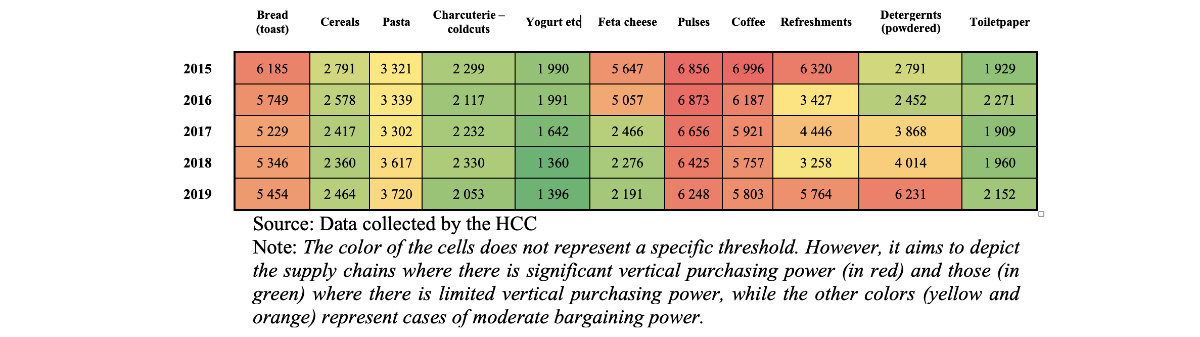

- Using an indicator of vertical market power at the supply chain level which corresponds to the vertical HHI index for all companies (suppliers and retailers) for the11 product categories we draws two important conclusions: a) while some markets are characterised by relatively stable and lowlevels of vertical bargaining power between 2015 and 2019 (i.e. breakfast cereals, cold cuts, yogurt and yogurt desserts and toilet paper), others (such as toast, pulses and coffee) are characterised by relatively high levels of vertical market power for the same (time) period and b) some markets show significant variations in the level of vertical market power during the above years.

Vertical market power (vertical HHI index) in the supply-chain-level for 11 product categories, 2015-2019

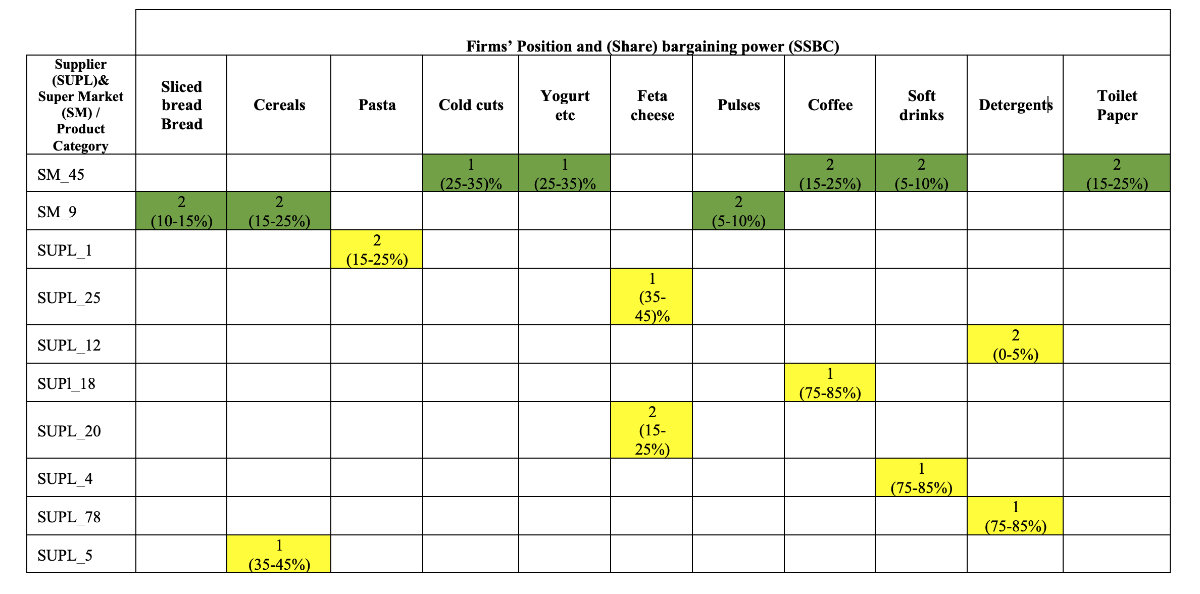

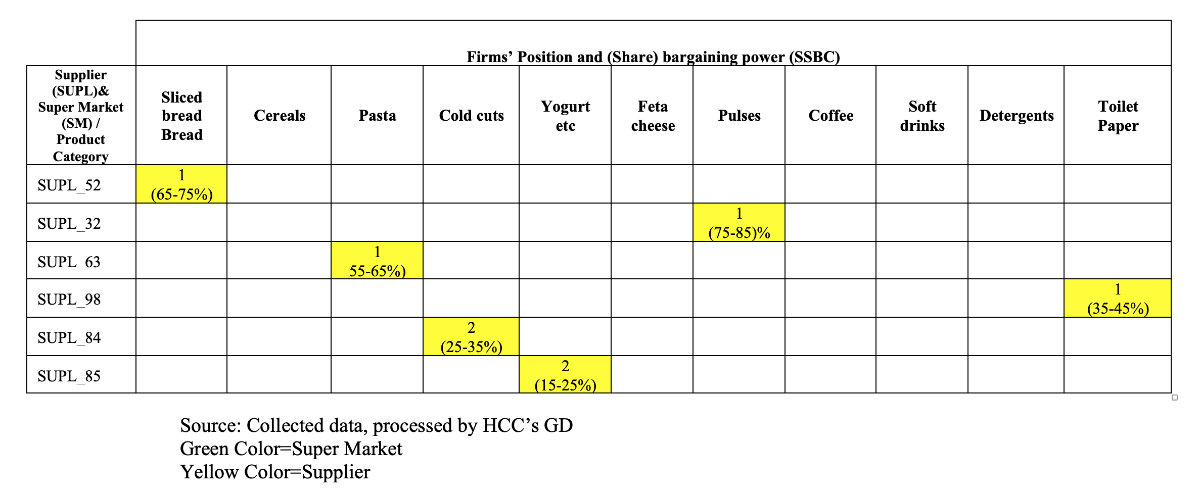

Also, based on the analysis on the distribution of vertical bargaining power, distribution in the market between suppliers and supermarkets in each of the supply chains, it is observed that in most of the product markets that were analysed, the suppliers hold the first place (most) of the bargaining power in each supply chain (see also relevant table below).

- In order to deal with unfair commercial practices by companies with significant bargaining power, it is deemed necessary to strengthen the HCC’s monitoring mechanisms through the use of direct digital information technologies, through complaints or through systematic market monitoring. For this purpose, the HCC introduces a whistleblowing system/tool, thus enabling someone to provide information without the fear of revealing his identity in any way.

- It is crucial to examine in detail the effects on competition of the restrictive measures implemented in the retail sector due to the COVID-19 pandemic.

Vertical market power distributed among central firms in the 11 afore mentioned product categories.